Millennials and the Phantom Wealth Illusion

- David Shahverdi, MBA

- Apr 23, 2025

- 5 min read

In recent years, Millennials have made significant strides in growing their net worth — at least on paper. Spurred by a decade of low interest rates, pandemic-era stimulus, and surging asset prices, Millennials have watched their financial statements swell. But behind these encouraging numbers lies a more fragile reality: much of this perceived wealth is what economists increasingly describe as "phantom wealth" — a form of prosperity that lacks durability and often fails to translate into lasting financial security.

This phenomenon is particularly acute for the Millennial generation, many of whom came of age during the Great Recession, only to face another economic shock with the COVID-19 pandemic. As a result, Millennials have seen rapid — but uneven — growth in their financial assets, and they now confront a unique paradox: more wealth, but not necessarily more financial stability.

The Illusion of Prosperity

According to data from the Federal Reserve’s Distributional Financial Accounts, Millennials’ total net worth grew from approximately $4 trillion in Q1 2020 to over $13 trillion by Q4 2023 — a remarkable tripling in less than four years. On the surface, this seems like a historic financial comeback for a generation long characterized as economically behind.

CHART 1 - Millennial Total Net Worth (2019-2023)

Millennial net worth has more than quadrupled between 2019 to 2023.

Source: Federal Reserve Board – Distributional Financial Accounts (DFA). Data extracted from the "Net Worth by Generation" view. Millennial net worth figures were estimated using Federal Reserve data on generational wealth in trillions of USD, capturing Q1 2019 through Q4 2023.

But a closer look at the composition of this wealth tells a more nuanced story. A large portion of Millennial net worth is tied to housing. The surge in real estate prices during the pandemic — fueled by low borrowing costs and limited supply — meant that homeowners saw significant gains in home equity. Between January 2020 and December 2023, U.S. home values rose over 40%, according to Zillow. Many Millennials bought homes at elevated prices, taking on substantial debt in the process.

Meanwhile, the bull market in stocks and crypto between 2020 and late 2021 contributed to portfolio growth. However, the volatility that followed in 2022 and beyond reminded investors just how ephemeral market gains can be. As a result, much of the increase in Millennial net worth is both market-sensitive and illiquid — two characteristics that make it vulnerable in a downturn.

Phantom Wealth Defined

The term "phantom wealth" refers to increases in perceived wealth that are not supported by equivalent improvements in underlying economic fundamentals — such as income, savings rate, or purchasing power. This kind of wealth is highly sensitive to fluctuations in asset prices and inflation and often fails to deliver true financial resilience. For Millennials, this concept is playing out in real time.

Despite the gains in net worth, real income growth for Millennials has been modest. The Federal Reserve Bank of St. Louis reports that median real wages for workers in the 25–44 age range increased by just 3% between 2019 and 2023, barely outpacing inflation. At the same time, the cost of essentials — including housing, childcare, education, and healthcare — has continued to rise, eroding the purchasing power of Millennial households.

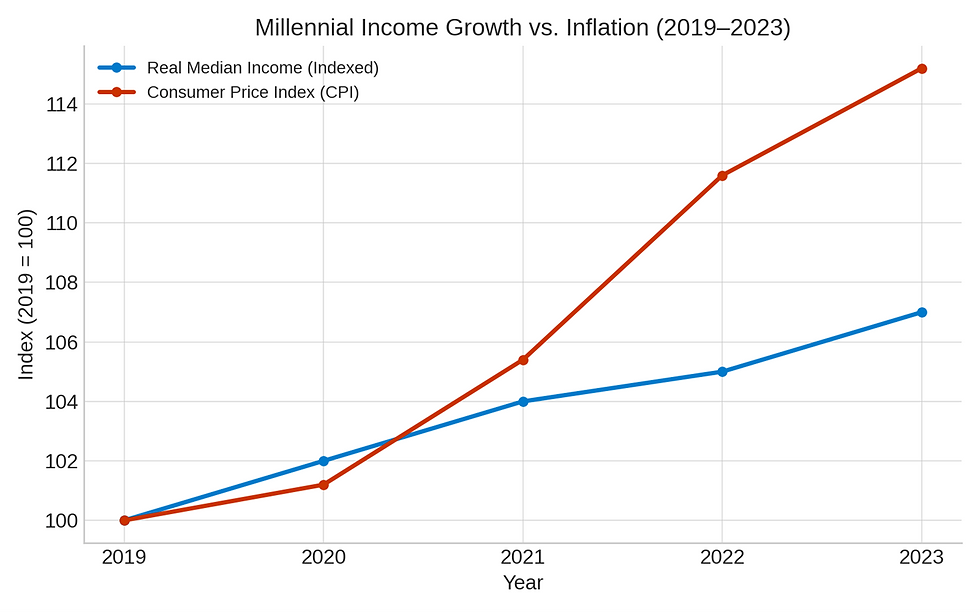

CHART 2 - Millennial Income Growth vs. Inflation (2019-2023)

Growth in CPI has overtaken Millennial’s Real Median Income since the pandemic. Sources: Real Median Income: U.S. Census Bureau – Income and Poverty Reports, Federal Reserve Bank of St. Louis – Median Usual Weekly Earnings (ages 25–44, used as a proxy). Inflation (CPI): U.S. Bureau of Labor Statistics – CPI All Urban Consumers

Moreover, much of Millennials’ wealth is concentrated in just a few asset classes: real estate, retirement accounts, and equities. These are valuable over the long term, but they do little to improve short-term liquidity or financial flexibility. For example: pulling money from a 401(k) before age 59½ can trigger taxes and penalties, while tapping into home equity requires taking on more debt in a high-rate environment.

CHART 3 - Estimated Millennial Asset Allocation as of 2023

Primary residence accounts for the biggest source of wealth for Millennials.

Source: Federal Reserve Board – Survey of Consumer Finances (SCF): SCF 2022 dataset used to estimate generational asset allocations. Data extrapolated to 2023 based on market and housing trends.

The Psychological Trap

The danger of phantom wealth is not only financial — it is behavioral. When people feel wealthier, they may increase their spending, reduce their savings, or make more aggressive investment choices. In the absence of real income growth, these decisions can create vulnerabilities that become apparent only when markets turn or unexpected expenses arise.

Millennials may also delay important financial planning steps — such as building emergency reserves, diversifying outside of real estate, or planning for future healthcare costs — under the impression that their growing net worth is sufficient protection.

In reality, a net worth inflated by market gains or home appreciation can quickly deflate if interest rates stay high, property values decline, or equity markets correct. What feels like financial progress can prove fleeting.

Turning Illusions into Stability

Many Millennials also say it is harder today to make it on their own that it was for their parents when they were starting out. Higher student loan balances, bigger mortgage payments and childcare costs, can make cash flows seem tight.

However, feeling financially secure is not only about how much money you have and earn, but also about the ability to spend less than you make. High prices due to inflation and scarcity have fostered the feeling of being overextended.

The key is to not only have a plan for one’s assets, but also for one’s personal expenditures.

Here are four practical steps to help you can take, to convert phantom wealth into real financial strength:

Rebalance for Liquidity: Maintain sufficient cash reserves and taxable brokerage accounts. While retirement accounts and home equity are valuable, they cannot easily be accessed when needed.

Assess current lifestyle and expenditures: Make sure that your current lifestyle and expenditures meet your personal needs and goals. Assess where your expenditures are going and whether you can reduce them to a level at which you feel comfortable.

Stress-Test Asset Assumptions: Revisit financial plans using conservative estimates for returns and property appreciation. Incorporate inflation and interest rate scenarios into long-term projections.

Diversify Beyond Real Estate: Explore assets that generate current income, such as dividend-paying stocks, short-term bonds, or real estate investment trusts (REITs), which can provide more flexibility.

Looking Ahead

Millennials are better positioned than they have been in years — but that position is precarious. While the gains of the past few years have been real in numerical terms, they may not be lasting unless paired with deliberate, disciplined planning.

In an era of heightened uncertainty, distinguishing between apparent and actual wealth is more important than ever. As advisors, it is our responsibility to help clients see through the illusion — and build a financial future that endures.

Comments